As the world seeks cleaner, more sustainable energy, green hydrogen is becoming a key enabler in achieving carbon neutrality. Electrolysis is the process of using renewable electricity to split water molecules into hydrogen and oxygen, creating a sustainable energy carrier. Green hydrogen is a truly environmentally friendly option because, unlike gray or blue hydrogen, it …

Home automation systems can be expensive and challenging to set up. But with careful planning and budget-friendly smart devices, you can transform your house into one with greater automation without breaking the bank. Beginning your home automation system slowly is the ideal way to learn the technology step-by-step and to ensure success in its implementation. …

Cracked smartphone screens can quickly ruin any day, but thanks to the right-to-repair movement, repairing broken devices is more cost-effective and simpler than ever before. All it takes are some tools and a little patience – you can also find detailed disassembly instructions and repair guides online for almost every brand. 1. Screen Replacement One …

Artificial intelligence (AI) is one of the biggest drivers of change in today’s business world. Automation through AI plays a major role in how businesses can improve efficiency and reduce costs. AI allows businesses to focus on growth and new ideas by automating tedious and difficult tasks. There are many applications for AI in business …

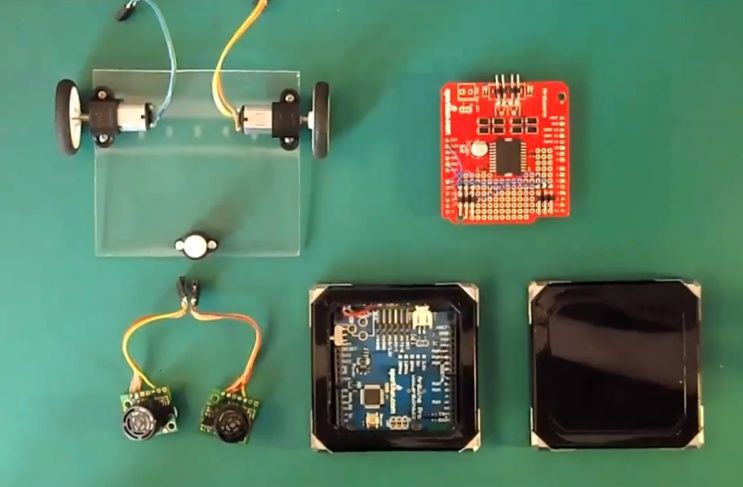

DIY tech projects provide many benefits that extend far beyond technical advancement, from developing an understanding of technology itself, driving innovation and creativity, and improving problem-solving abilities to personal development and entrepreneurship–strengthening resilience and perseverance along the way. Do-it-yourself projects allow people to tailor their gadgets according to specific preferences and needs, potentially cutting costs …

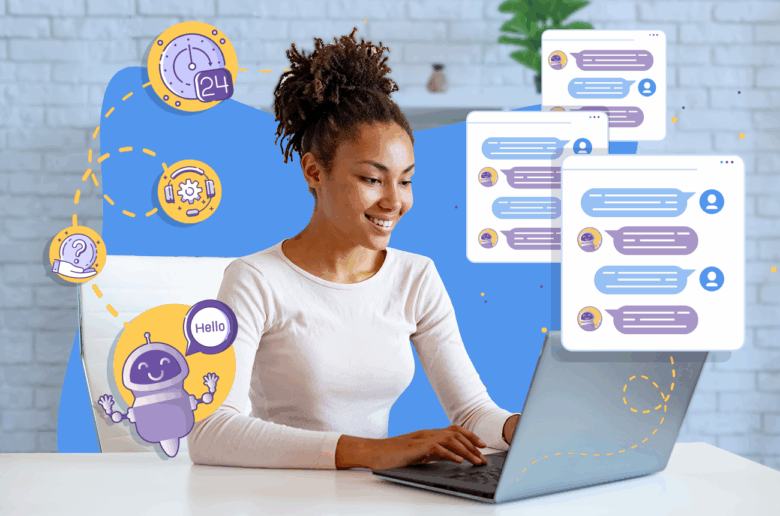

Customer service has changed dramatically since the dawn of the digital age. Businesses are turning to automation to better meet customer expectations, as they increasingly demand immediate assistance and personalized experiences. Chatbots are one of the most revolutionary technologies in this shift. These automated assistants can handle a high volume of customer contacts on their …

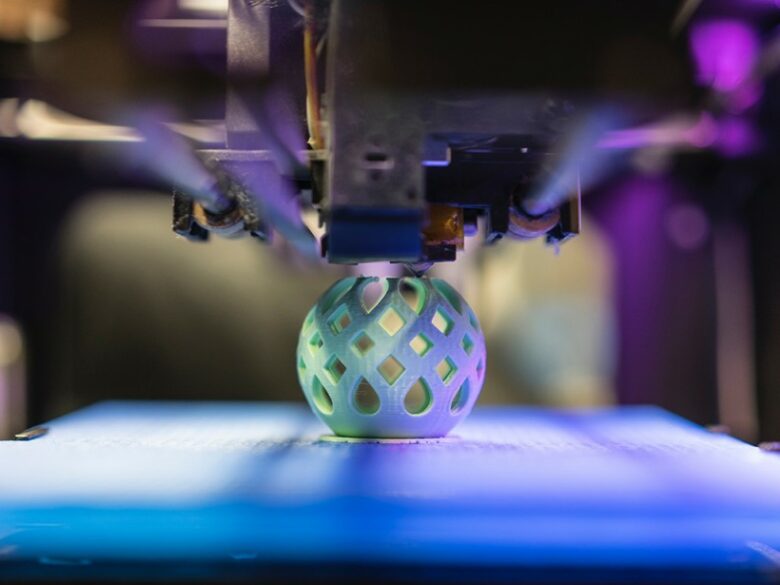

3D printing has transformed the way we bring ideas to life. What was once limited to industrial applications is now accessible to hobbyists and creative minds everywhere. Whether you’re a seasoned maker or just starting your 3D printing adventure, the possibilities are endless. With a 3D printer at your disposal, you can turn digital designs …

In today’s fast-paced business environment, manually processing funds can be time-consuming and error-prone. Financial obligations get more complicated as a business expands. From tracking expenses and generating invoices to reconciling bank statements and preparing tax returns, accounting tasks can quickly become daunting. Automation simplifies these tasks with the help of intelligent software. Automating accounting tasks …

The threats posed by the digital age are changing at an unprecedented pace. The rapid advancement of technology, particularly in quantum computing, presents a new threat to privacy. Hackers have begun exploiting weaknesses in traditional encryption technology. However, the advent of quantum computers could be our best defense against cyberattacks or our worst nightmare. The …